At the same time, buyer has to apply for a home loan. The malaysian government announced that stamp duty exemptions on for memorandum of transfer documents (mot) and loan agreements will be provided for first time home buyers who purchase a residential property from 1 january 2021 to 31 december 2025.

Malaysia Johor Bahru Flat Landmarks Vector Illustration Malaysia Johor Bahru Line City With Famous Travel Sights Design Sky Johor Logo Design Diy Landmarks

Participants are required to be malaysian citizens above the age of 18, with a household income of rm3,000 to rm6,000.

First time home buyer scheme malaysia. As for investors such as banks, they can choose to stay on or sell their 80 per cent share to other institutions. The “skim rumah pertamaku” or my first home scheme was first announced in the 2011 budget by the malaysian government. The scheme allows eligible applicants to obtain loan financing up to 110% of the price of a property , providing a path to homeownership without the need for a substantial down payment.

Buyer and seller sign the sales & purchase agreement, and buyer also signs the offer letter for approval of home loan. The scheme allows homebuyers to obtain 100% financing from financial institutions, enabling them to own a home without having the need to pay a 10% down payment. Permanent staff at current company, employed for at least 6 months.

However, kuala lumpur city plan 2020 (2008). According to the requirement, first time home buyer must be age between 24 and 34 years old. This is one of the good initiatives taken by the government to help young adults earning rm5,000 per month or less to get 100% financing from banks to.

The buyer can choose to be in the fundmyhome scheme for another five years, with the condition that the buyer tops up with additional money to fulfil the 20 per cent portion if the property’s value has gone up. There is alot of interesting facts about buying your first home. First time home buyer benefits malaysia 1.

The remaining value of the property is taxed with the standard 5 % stamp duty rate. The scheme allows homebuyers to obtain 100% financing from financial institutions, enabling them to own a home without having the need to pay a 10% down payment. First time house buyer within one household family.

In the most recent 2019 budget, the government of malaysia has introduced a home financing initiative to first time house buyers from lower income group for the purchase of houses priced up to rm300,000. The house is not allowed to be sold for a. Introduction of my first home scheme (skim rumah pertamaku, srp) this scheme was first announced in budget 2011 to assist fhbs towards owning a home without having to pay a down payment.

Single borrower's gross income not exceeding rm5,000/month. Under the my first home scheme, all malaysian fhbs without any record of impaired financing for the past 12 months are eligible to apply. Actually, the scheme has been ongoing ever since it was announced in budget 2016 but don’t worry, you’re not too late for this year’s application.

“bnm affordable home scheme” is a special measure announced by bank negara malaysia which aims to assist lower income group to own a home. Applicant must eligible to get a bank loan from any bank in malaysia. The scheme is open to those with a gross household income of below rm10,000 a month.

Believe us when we say that first time home buyers in malaysia are in for the greatest treats that they will ever experience. For joint application with combined gross income of up to rm10,000/month. This scheme is known as first house deposit financing scheme or mydeposit, and is aimed at malaysians who want to buy houses for the first time.

In malaysia, first time home buyer can be defined based on requirement mention by government for first home scheme. What is bnm affordable home scheme? Call me for more information.rish (ren 44761)0107068386eu as prop.

Alot of infos in my video.

Im A Fresh Graduate Can I Apply For A Home Loan In Malaysia Propertyguru Malaysia

First Time Home Buyer Housing Loan Personal Banking Always With You Malaysia

Difference Between Wire Transfer Swift And Ach Automated Clearing House Automation Transfer Wire

Budget 2019 Property And Housing Summary - Malaysia Housing Loan

Malaysia No Longer In Middle-income Trap Wma Property Income Malaysia Gross National Income

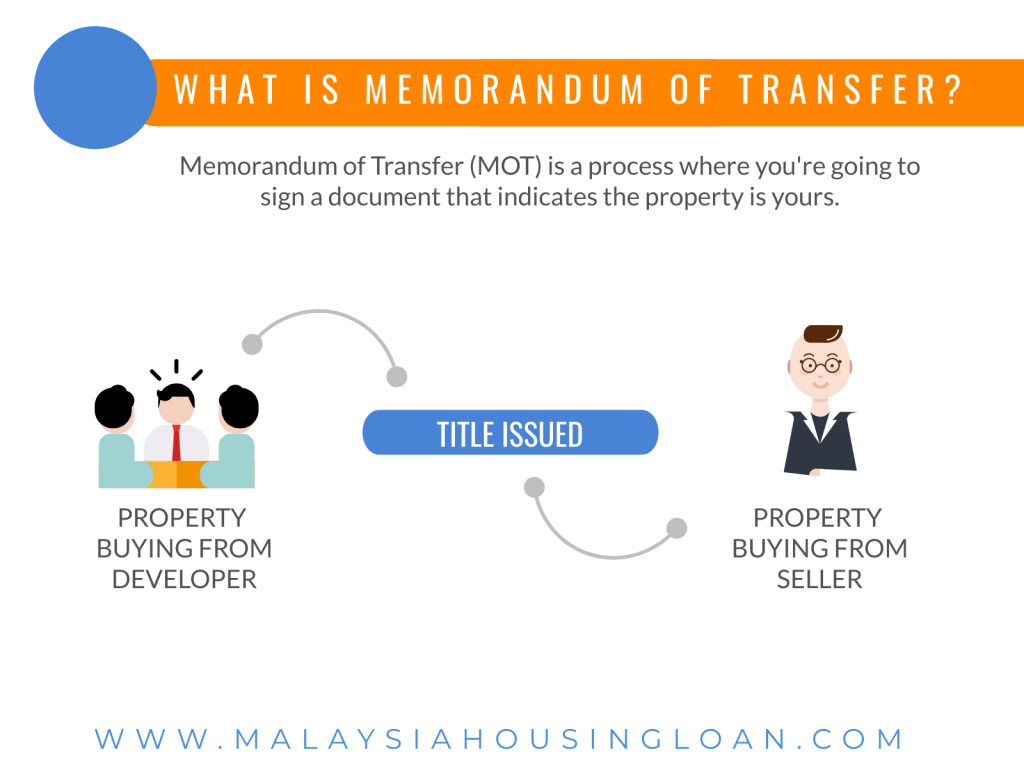

Memorandum Of Transfer Malaysia 2021 - Malaysia Housing Loan

Progressive Payment Schedule For A Property Under Construction In Malaysia Propertyguru Malaysia

Memorandum Of Transfer Malaysia 2021 - Malaysia Housing Loan

Dsr Heres How To Calculate Your Debt Service Ratio In Malaysia Propertyguru Malaysia

Memorandum Of Transfer Malaysia 2021 - Malaysia Housing Loan

Interior Stylist Writer And Tv Presenter Sophie Robinson Cleverly Combines Fabrics F Living Room Wall Color Eclectic Living Room Curtains And Blinds Together

Memorandum Of Transfer Malaysia 2021 - Malaysia Housing Loan

Flexi Housing Loan Personal Banking Always With You Malaysia

Pin On Mbsb

Best Low Interest Rate Housing Loans In Malaysia 2021 - Compare And Apply Online

Pin On Brandywine

Memorandum Of Transfer Malaysia 2021 - Malaysia Housing Loan

Pin On Home To Be

Pin On Investment Cycle

/cdn.vox-cdn.com/uploads/chorus_image/image/67066886/106243615_187258502740440_7754586114805213927_n.0.jpg)

Tidak ada komentar:

Posting Komentar